BLOG

23 June 2021

Barclays Makes Image Survivable Features Compulsory on Cheques

For the past 12 months, major banks have been requesting that an Image survivable Feature (ISF), such as a UCN, be included on all cheques as soon as possible to help reduce the incidence of fraud. Barclays has recently declared that ISF’s are now compulsory on all their cheques. This has been implemented as of… Continue reading Barclays Makes Image Survivable Features Compulsory on Cheques

For the past 12 months, major banks have been requesting that an Image survivable Feature (ISF), such as a UCN, be included on all cheques as soon as possible to help reduce the incidence of fraud.

Barclays has recently declared that ISF’s are now compulsory on all their cheques. This has been implemented as of 1st June 2021.

A1 Security Print can produce cheques containing an ISF which is fully approved by Barclays, as well as all other major UK banks. Please find more details below.

What is an Image Survivable Feature (ISF) and why are they required?

UK banks introduced a new way of clearing cheques in October 2017 whereby the image of a cheque is now scanned and processed rather than the traditional physical cheque clearing method. This has made the cheque clearing process much faster and allowed other advances such the scanning and processing of cheques via mobile phones for some banks. However, the new system has also led to a large increase in cheque fraud losses. According to annual UK Finance report ‘Fraud – The Facts’, cheque fraud losses increased to £20.6million in 2018 and again to £53.6 million in 2019.

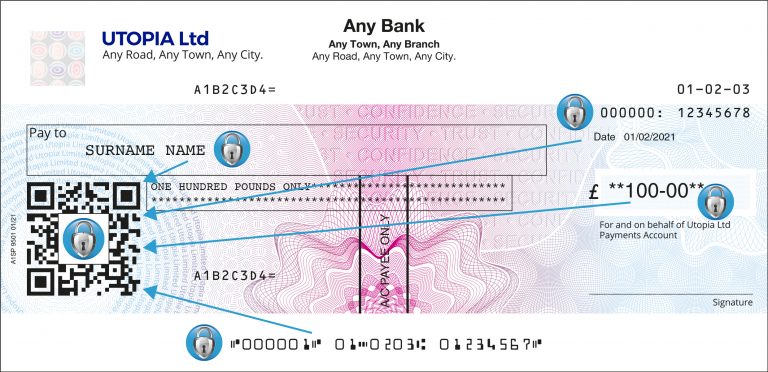

Due to this increase in cheque fraud the banks are now requesting that Image Survivable Features (ISF) are added to all cheques. An ISF is a security device added to the cheques which is used to identify that a cheque is genuine during the banks’ image scanning process. A1SP is one of the few specialist cheque manufacturers in the UK who now produce cheques with an ISF which is fully accredited by the major UK banks including Lloyds, Nat West, HSBC, RBS and Ulster Bank. We have been successfully adding our ISF to large number of cheques since June 2020.

We offer 2 different options of ISF features which deliver different levels of security.

Option 1 – UCN

UCN stands for Unique Coded Number. It is an ISF consisting of an encrypted code number printed on the face of the cheque. We encrypt the individual Cheque Number, Sort Code and Account Number into an alphanumeric string using a highly secure encryption algorithm which is printed onto the cheque in two designated positions. The UCN is always printed in two locations to ensure capture even if a receipt stamp has been used or it is otherwise obscured.

The UCN is validated during the clearing process against the actual image of the cheque and any discrepancies are automatically flagged for review by fraud prevention operatives in the clearing system. As an Image Survivable Feature, the UCN will remain visible on the cheque after scanning and the cheque image passed into the new image-based clearing system for processing.

The result is comprehensive validation and protection against counterfeit cheques.

This method is used primarily for cheque books and when a cheque base stock is supplied to a customer pre-encoded with the MICR line ready to be used with their in-house cheque infilling software.

Option 2 – UCN Plus

UCN plus is another option to consider when adding an ISF to a cheque.

UCN Plus offers the highest level of protection when clearing the digital image of a cheque. The difference is that UCN Plus can only be added at the time the Payee details are added to the cheque. The payee and the amount payable are included within high level security encryption process. This then appears on the cheque as a QR code. However, the QR code cannot be read by a standard QR code scanner and can only be read by scanners that have the encryption key. The cheque clearing process used by banks has this key.

The result is full security protection for each cheque, ensuring that the cheque is genuine and that there has been no alteration to the payee or amount details.

If you currently infill your own cheques and your accounting software does not have the ability to add the UCN plus. There are two options that A1SP can help you with.

- A1SP offers a full in-house bureau service at our high security factory in the Midlands. Simply transfer your payment data through one of our secure data transfer portals and we take care of the rest. This is a cost-effective, hassle free option to deal with all your payment needs. We can handle cheque runs from as small as 10’s of cheques up to 100,000’s of cheques, so can accommodate businesses of all sizes.

- Do you still want to keep the cheque infill and postage in house? If so, A1SP works in partnership with a software provider who can supply an easy to use cheque payment software system that adds UCN Plus automatically to all of you cheques.

What to do next?

A1SP can assist with every step of the process of introducing an ISF to your cheques. We can advise on the best option to fit your requirement and arrange the programming necessary to create the UCN and ensure that everything is fully compliant for processing through the banks image clearing system.

Contact us now to enquire.